The 45-Second Trick For What Is Trade Credit Insurance

Wiki Article

The Facts About What Is Trade Credit Insurance Revealed

Table of ContentsThe 3-Minute Rule for What Is Trade Credit InsuranceThe Single Strategy To Use For What Is Trade Credit Insurance5 Simple Techniques For What Is Trade Credit InsuranceThe Of What Is Trade Credit Insurance

This is offered by some trade money specialists covering the prospective hold-ups to payment which could come from money transfer constraints, or the insolvency of a government purchaser. Our political danger insurance coverage assists companies to protect their abroad financial investments in scenarios such as political physical violence or confiscation of possessions, or other threats pertaining to the activities of an international government.The premium is computed as a portion of the total quantity of revenue being guaranteed, starting from around 0. 15% of insurable turnover. Sometimes it does exercise a lot greater than this if there is incomplete credit rating background or other warnings. Just like any kind of insurance policy, there is a computation to be done around threat.

They designate each of those clients a quality that reflects the health and wellness of their task and also the way they carry out company. Based on this threat evaluation, each of your buyers is after that given a specific credit scores limit up to which you, the guaranteed, can trade and have the ability to claim needs to something fail.

What Does What Is Trade Credit Insurance Do?

The warranties will cover trading by residential firms as well as exporting companies and also the intent is for agreements to be in area with insurance companies by end of this month. The guarantee will certainly be temporary as well as targeted to cover Covid-19 financial obstacles, as well as it will certainly be adhered to by a review of the TCI market to ensure it can best support companies in future.It is vital to obtain the information right so that the scheme helps companies as well as insurance companies, as well as additionally supplies value for money for the taxpayer. It is important that insurance providers can preserve their underwriting requirements and also run the risk of monitoring techniques, to make certain that assistance is provided to services that can trade out of the present circumstance - What is trade credit insurance.

Provided the unexpected disruption to economic task, and also the boosted dangers of insolvency and default on the market, trade credit score insurance firms might immediately take out several of the protection that they currently supply in order to continue to be sensible. The option would be to raise costs somewhat that is expensive for all events.

Profession credit history insurance coverage plays a particularly substantial duty in non-service industries, such as manufacturing as well as building, giving services special info the confidence to trade with each other. The Federal government is keen to make certain that these markets are not take into further distress as an outcome of the Covid-19 crisis. This system will make certain that supply chains continue to be protected from the possible cause and effect of profession interruption and also company defaults.

What Is Trade Credit Insurance for Dummies

The information are still being settled by the UK Government as well as being gone over with insurance firms. The government is working with industry to finalise the information of the system.

The Federal government is functioning with sector to settle the terms as well as conditions of the plan. The Government's priority for this scheme is to deal with insurers to sustain check my blog UK companies. Additional information of the system will certainly be introduced in due program. It is the Federal government's purpose that this system will allow the profession credit scores market to operate as regular, as far as possible.

What Is Trade Credit Insurance Can Be Fun For Everyone

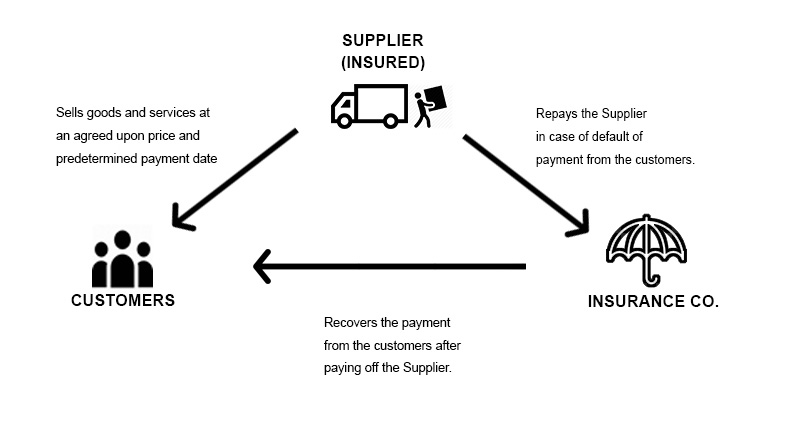

Additional information of the scheme will certainly be announced eventually. The Federal government's top priority for this plan is to sustain UK companies that can be affected by the withdrawal of profession credit score insurance policy cover throughout the Covid-19 crisis. In the longer term, it will be ideal to assess the performance of this intervention, analyze exactly how the marketplace responded to financial disturbance, and think about just how it can proceed to ideal serve services.While the biggest operators in the marketplace are abroad firms, this is not a bailout for insurance companies. We are working with the insurance companies to ideal assistance British businesses. Trade debt insurance offers defense for businesses when customers do not pay their financial obligations owed for products or solutions. The plan will certainly compensate the insurance holder in case of the purchaser's non-payment, as much as see page a certain credit line established by the insurance company.

This could aggravate the financial impacts of the pandemic by causing issues for liquidity and also functioning funding for buyers and destructive count on supply chains.

The sales of goods and also solutions are subjected to a significant variety of dangers, most of which are not within the control of the vendor. The greatest of these risks and also one that can have a tragic influence on the viability of a supplier, is the failing of a customer to spend for the items or services it has acquired. What is trade credit insurance.

Report this wiki page